Legacy Donor Story: Emily and Paul Morrow

Good News in 2023

Good News in 2023

Rates for Charitable Gift Annuities (also known as CGAs) are up this year. That’s good news if you wish to make a legacy gift to Shelburne Farms that pays you a steady income for life. A CGA is an arrangement between a donor and a nonprofit in which the donor receives regular lifetime payments based on the value of assets transferred. Working with the Vermont Community Foundation you can create a CGA that pays you a fixed income and ultimately benefits Shelburne Farms. The process is simple.

New for 2023: if you are 70 ½ or older you can fund a CGA with a one-time qualified charitable distribution (QCD) of up to $50,000 from your IRA (up to $100,000 per couple!). Here’s how Emily & Paul Morrow are taking advantage of this taxwise gift strategy.

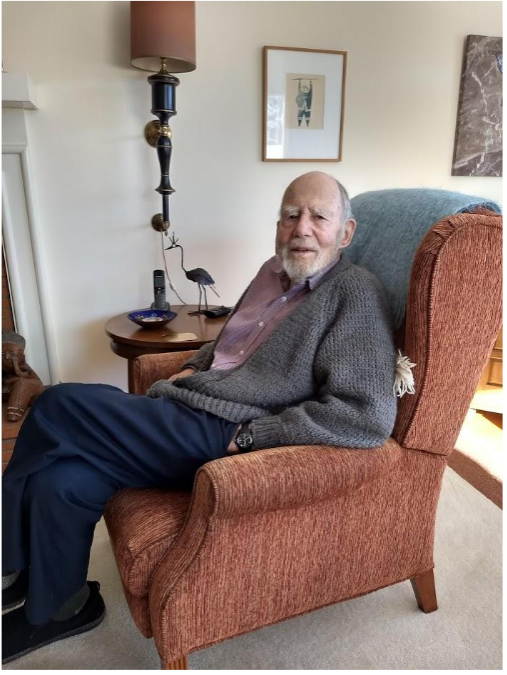

Emily and Paul Morrow enjoy the best of all worlds. After successful careers practicing law and medicine in Vermont, they’ve lived the past 14 years as residents of New Zealand where Emily is a legal consultant and Paul a forensic pathologist.

The Morrows return to Vermont in the summer. You may run into Emily walking the trails at Shelburne Farms or find Paul enjoying the sunset from their home overlooking Lake Champlain in Shelburne.

“I look at my life in chapters,” recalls Emily, who was a practicing tax attorney for 25 years and served on the Shelburne Farms board from 1987 to 2005. She and Paul have been supporting Shelburne Farms for more than three decades.

When they moved abroad, Emily launched a consulting business and now she is preparing to be a full time student at the University of Auckland enrolled in a masters program in counseling. “I’ve always been interested in psychology and there’s a shortage of mental health counselors in New Zealand.” Emily and Paul are helping to fund this next chapter of life with quarterly payments from a Charitable Gift Annuity established to benefit Shelburne Farms.

Motivated by 2023 changes signed into law through the SECURE 2.0 Act, Paul made a one-time qualified charitable distribution from his retirement account directly to the Vermont Community Foundation to fund a Charitable Gift Annuity to benefit Shelburne Farms. Had he taken the amount directly from his IRA as a required minimum distribution, the Morrows would have been responsible to pay income tax on that distribution. But, because they are charitably inclined and established a CGA, their tax liability is reduced and paid over their lifetime when annuity payments are received. Now that’s taxwise giving! This is the Morrow’s second Charitable Gift Annuity to benefit Shelburne Farms through the Vermont Community Foundation.

Questions? To learn more about establishing a CGA that pays you income for life and then benefits Shelburne Farms, contact Sue Dixon: sdixon@shelburnefarms.org 802-985-0322.

Legacy Donor Story: Dan and Carol Wilson

From the time we first visited Shelburne Farms 30 years ago, we’ve been impressed with the beauty of the working farm, with the pleasures of the Inn, with the careful stewardship of the land, and with the educational ventures for children and adults. We have included a bequest to Shelburne Farms in our will so that this marvelous place will continue its good work for many years to come.

Legacy Donor Story: Dieter Gump

“I can’t remember a time when I didn’t know Shelburne Farms,” recalls Dieter Gump, active outdoorsman and retired University of Vermont professor.

A few years ago, Dieter discovered of a Life Insurance policy that he had paid in full and no longer needed. He requested a “change of beneficiary form” from his plan administrator and named Shelburne Farms as beneficiary of the policy. Thus Dieter and his wife Valerie were able to fulfill their dream of making a legacy gift. No lawyers, no fees – it was that simple.

Beneficiary Designation is one of the easiest ways to support Shelburne Farms with a legacy gift. You simply fill out a form naming Shelburne Farms as a beneficiary to receive assets, such as all or a portion of retirement plans and life insurance policies after you are gone. This is entirely separate from your will, and you may adjust beneficiary designations at any time.

Legacy Donor Story: Shirley Murray

Never one to idle, Shirley Murray took up volunteering at Shelburne Farms after retiring from teaching kindergarten. Thus began a friendship that would span decades. Shirley’s curiosity and love of learning made her a natural fit volunteering with our historic Archives & Collections. There, she spent countless hours reading and transcribing Lila Webb’s journals. When Shirley passed away in 2021 at age 93, she left a legacy of love through her work with Lila’s journals that connects us to the past. She also made a generous gift to Shelburne Farms’ endowment through a bequest in her will that will enable the organization to continue to carry out its mission long into the future. We are deeply honored that Shirley chose to include Shelburne Farms in her estate plans.

Legacy Donor Story: Judy Brook

Working on my estate plans, my lawyer asked, “What do you believe in and value that you want to see continue beyond your lifetime?” – pause – Well, I believe in the power of education and I value the beauty and spirituality that I find in nature. Shelburne Farms…. the property, the people, the programs comes to mind.

Shelburne Farms has been my “home away from home” for the last 25 years. It is where I began volunteering by caring for the sheep during lambing, joined as staff in the Children’s Farmyard, and where I have been Tour Guide Program coordinator for eleven years. It is where my husband and I courted and became committed partners.

The Farms is an amazingly beautiful 1,400 acre of classroom for teaching sustainability. It’s a place were the highly skilled, friendly, and knowledgeable explore with students, replace old pipes, grow lettuce, cook and clean; and its where creative teachers lead classes, camps, and conferences that support children, and all who want to make the world a better place.

Every day, Shelburne Farms inspires me as a teacher, learner, poet, artist, photographer. And, yes, as a philanthropist. Working through my professional advisor, I created a Trust that shall continue providing monetary support for Shelburne Farms, long after I’m gone, carrying my values into the future.

I hope others will join me in expressing gratitude and sharing the abundance.– Judy Brook

Questions?

Through careful gift planning, people often discover that they are able to have even greater impact than they had imagined possible. Bequests naming Shelburne Farms as beneficiary help to ensure that the Farm’s groundbreaking EFS (“Education for Sustainability”) programs and partnerships continue engaging young people – along with their guiding families, teachers, & elders – to shape healthy and just communities worldwide.

Questions? Contact Sue Dixon Special Gifts Coordinator, at sdixon@shelburnefarms.org or call 802-985-0322